Sketchy bankruptcy at Lyoness Europe AG! Numbers don’t lie. Freidl & Friends treated themselves to over 30 million CHF.

A business assessment reveals that over 50 other companies are associated with Lyoness Europe AG and that 6 million CHF cannot be attributed.

A renowned Swiss auditor analyzed the insolvency notification for Lyoness Europe AG. According to the assessment, Lyoness Europe AG, based in Buchs/Switzerland, was a “self-service store” from which Hubert Freidl and others generously helped themselves over the years.

According to the business assessment, he owes the company over 30 million CHF, and there also seems to be bankruptcy delay, which should also be legally relevant.

Assignment of the auditor:

It was to be determined whether liquid assets or recoverable receivables (or other assets) are available in the company to satisfy creditor claims.

Documents submitted:

- Overindebtedness report from the District Court Werdenberg-Sarganserland regarding Lyoness Europe AG dated 23.10.2023.

- Audit report by Audit Solution AG on the balance sheet and income statement of Lyoness Europe AG (on going concern and disposal values) as of 31.12.2022.

- Balance sheet and income statement of Lyoness Europe AG as of 31.12.2022 including previous year figures.

- Audit report by Audit Solution AG – hereinafter referred to as the auditing company – on the balance sheet and income statement of Lyoness Europe AG as of 31.12.2022 dated 15.10.2023.

- Balance sheet and income statement of Lyoness Europe AG as of 31.8.2023 dated 15.10.2023.

- Cantonal commercial register extract (SG) of Lyoness Europe AG in liquidation dated 21.10.2023.

The auditor expressly points out that the analyses presented are based on incomplete and unverified data, and accordingly, there is a risk of misinterpretation. Lyoness Europe AG has failed to submit a proper balance sheet since 2003, which is significant.

Based on the documents provided, over fifty companies are identifiable as being associated with Lyoness Europe AG according to the presented balance sheet, which must be assumed as connected entities. It was assumed that all companies for which an offset account was maintained should be considered connected.

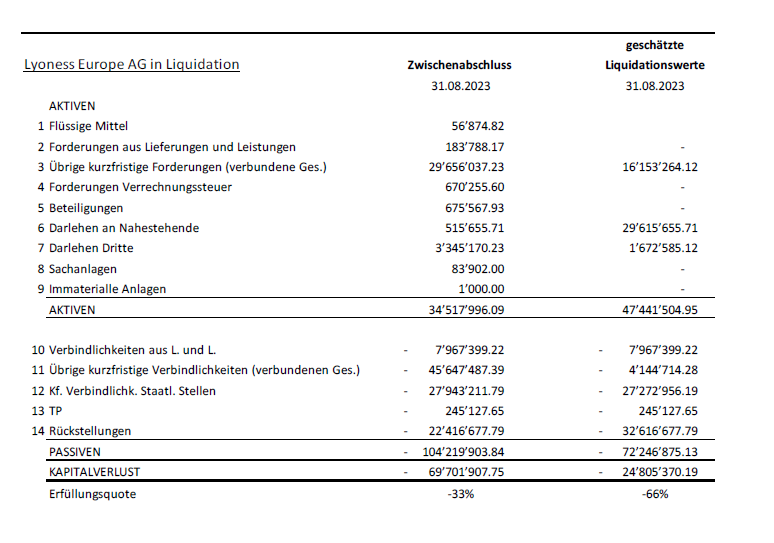

The following is a provisional liquidation balance sheet as at 31 August 2023

Below is a preliminary liquidation balance sheet as of August 31st, 2023:

The company’s liquid funds amounted to CHF 56,874.82 at the time of the interim financial statements as of August 31st, 2023, with simultaneous liabilities of CHF 104,219,903.84 resuting in a Capital Loss of CHF 69,701,907.75 (-33%).

Nevertheless, substantial loans were previously generously granted to third parties (CHF 3,345,170.23) and related parties (CHF 29,615,655.71).

It also appears that the bankruptcy was to be concealed,

• Different offset accounts are used with the same account number.

• Active accounts are listed among the liabilities and vice versa.

• Several offset accounts in the same currency from the same business partner are listed on both the asset and liability sides.

• The balance of receivables and liabilities of business partners is not discernible, as there is no appendix for the financial statements for 2022 and the interim financial statements as of August 31st, 2023.

The distribution of profits to Hubert Freidl is not possible under Swiss law. Since no free equity was available, the distribution of profits constitutes a repayment of deposits according to Art. 680 para. 2 OR, i.e., a monetary benefit. See Art. 678 para. 1 OR in conjunction with Art. 757 OR (claims in bankruptcy).

Art. 678 para. 1 OR – Shareholders and members of the board of directors as well as related parties who have received dividends, bonuses, or other profit shares unjustifiably and in bad faith are obligated to refund.

Art. 757 para. 2 OR – If the bankruptcy administration waives the assertion of these claims, any shareholder or creditor is entitled to do so. …

Regardless of whether the monetary benefit or profit distribution was legally justified or not, the Swiss Federal Tax Administration will assert and enforce the withholding tax claim.

Conclusion of the auditor:

“Additional (potential) claims of the company of around CHF 30 million were identified within the scope of this analysis.”

“An unauthorized transaction benefiting Mr. Freidl and related parties of around CHF 30 million was identified. If this suspicion is confirmed, there is a monetary benefit (hidden profit distribution), and from this, Lyoness Europe AG, the injured party, would have a claim for repayment against Mr. Freidl and the related parties.”

This would constitute a violation of the law; thus, Lyoness Europe AG would have a claim for repayment against Freidl. This would mean that Freidl owes Lyoness Europe AG and its creditors over 30 million CHF. Additionally, over 50 other companies are involved in this bankruptcy. Since it could not be determined which of the over 50 other companies associated with Lyoness Europe AG are involved, it can be assumed that all of them are.

The audit report was also forwarded to the chief prosecutor at the Federal Public Prosecutor’s Office for White‐Collar Crime and Corruption (WKSTA).

The fact that Freidl is said to have already deregistered in Europe and settled in South America also leaves a bitter taste. The fact that many top leaders either completely departed from Lyconet/myWorld or relocated their residence to Dubai or South America leaves room for interpretation.

Leave a Reply

Want to join the discussion?Feel free to contribute!