Cryptix AG knows nothing! Publication about discontinuation of FMA proceedings is wrong! But no IPO for Lyoness/Lyconet/myWorld?

As we have already reported, Hubert Freidl announced Lyoness/Lyconet/myWorld’s latest business idea in an online sensation at the beginning of the year: “The company will go public”. His followers were called upon to convert their shares into myWorld Share Points.

As we had already reported, we have justified doubts about this IPO. This is because Cryptix d.o.o. is no longer listed at the BaFin (German Federal Financial Supervisory Authority) and there is no cooperation with CM-Equity AG. To recall the details in more detail, read our article from January 19, 2021: : Freidl‘s Börsengang! Marketer die umsteigen verzichten so ziemlich auf alles! CM Equity AG & Cryptix d.o.o am 18.01.2021 laut aktuellen BaFin-Auszug ausgestiegen! – BE KONFLIKTMANAGEMENT (bekm.eu)

But now there is a twist in the exclusive and secret “IPO” case. This should please the members, however less, after they had followed the advice of Freidl, and had invested once again.

On January 22, 2021, Cryptix AG published a statement regarding our article mentioned above. As expected, the company accused our CEO Ben Ecker of spreading false information: Cryptix AG has no connection to myWorld, CM-Equity is unknown to them and neither Cryptix AG nor Blocktrade SA are in contact with BaFin. Publication of Cryptix AG: Announcement: : Announcement: Correcting Misinformation in Social Media – Cryptix

However, it is dubious that the activity ETR AG, which is intertwined with Cryptix AG, was already prohibited by the FMA Liechtenstein on 07 July 2020 and continues to be prohibited. Cryptix AG claims on its website, however, that the FMA have since discontinued their investigations.

This publication of Cryptix AG is wrong: : FMA Proceeding Involving ETR AG Dismissed – Cryptix (FMA proceedings against ETR AG discontinued). Only the Liechtenstein public prosecutor’s office has not initiated any criminal proceedings, but this has nothing to do with the FMA’s decision. In this case, information was presumably deliberately misrepresented in order to reassure block trade customers.

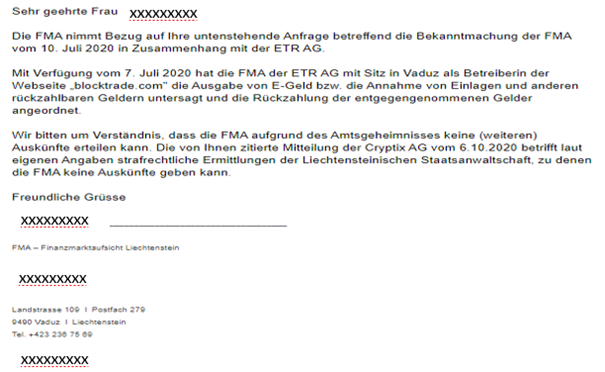

Upon request to the FMA (Financial Market Authority Liechtenstein), regarding the current status quo, we received the following message on March 31, 2021:

Here the English translation of the E-Mail above:

„The FMA refers to your inquiry below regarding the FMA’s announcement of 10 July 2020 in connection with ETR AG.

By order dated 7 July 2020, the FMA prohibited ETR AG, domiciled in Vaduz, as operator of the website “blocktrade.com”, from issuing e-money or accepting deposits and other repayable funds and ordered the repayment of the funds accepted.

We ask for your understanding that the FMA cannot provide any (further) information due to official secrecy. The communication from Cryptix AG dated 6.10.2020 cited by you relates, according to its own information, to criminal investigations by the Liechtenstein Public Prosecutor’s Office, on which the FMA cannot provide any information“.

However, we will ask Cryptix AG again for a statement, maybe this time the Senior Manager of Corporate Communications of Cryptix AG will manage to answer our questions truthfully.

We already asked the Senior Manager of Corporate Communications of Cryptix AG about various points. On March 02, 2021, we then received a reply to our email in which we asked her about what the supposed IPO is all about.

The most important statements from this email correspondence can be summarized as follows:

- Cryptix AG knew nothing about a long-lasting friendship between Cryptix AG founder Bernhard Koch and Hubert Freidl. They are also not aware of the mutual idea of introducing eCredits. Editor’s note: The opinion of our CEO Ben Ecker on this is: “Anyone who knows the rope networks in these companies knows that the two know each other more than well.”

- Regarding the fact that ETR AG is 100% operated by Cryptix AG. Blocktrade S.A. is represented by the people who also manage Cryptix AG. Editor’s note: It is proven that Blocktrade S.A. is owned 100% by Silvia Freidl, wife of Hubert Freidl. We have documented this in an article with the commercial register excerpts already on February 17, 2021: Freidl’s IPO! ” The circle is closed!” What and who is behind the Cryptix Group and Blocktrade S.A.. Who is actually managing the “big IPO now?”

- The company CM-Equity was known to Cryptix AG and they had also cooperated with them. Editor’s note: It is striking that until January 18, 2021, a cooperation between Cryptix d.o.o. and CM-Equity was listed at the BaFin. Prior to that, our CEO Ben Ecker educated the CEO of CM-Equity about myWorld and its business models in an email dated January 11, 2021. One week later, the cooperation with the subsidiary Cryptix d.o.o. has been terminated.

- Although the IPO had already been advertised by Freidl, after which many members in myWorld Share Points paid in funds again and had hoped for Benefit Vouchers, Cryptix AG continues to deny having had anything to do with it. Cryptix AG does not want to know anything, but is involved everywhere as an extended arm of Hubert Freidl.

As you can see, the senior manager of Cryptix AG’s corporate communications was unable to answer our questions. On the contrary: She did not even address the questions that would have been of particular interest to us, but tried to cover something up with relativizing answers.

But the lady was able to confirm one thing in the context of our e-mail correspondence: Cryptix AG knows nothing about an IPO!

This is extremely strange, considering that Cryptix AG, which cooperates with ETR AG, which in turn operates Blocktrade.com, should know better. We are very grateful to Cryptix AG’s Senior Manager of Corporate Communications for verifying our concerns. It is certainly not possible for the simple marketers, from whom Freidl & his Keilertruppe can live well, and certainly desired by myWorld, that they can see through or even understand this whole corporate quagmire.

But we still have a few questions about the mysterious IPO:

On which stock exchange is the myWorld group, or one of its many companies, listed at all?

What is the securities identification number?

Where, and above all by whom, were the applications filed?

© by BECM Inc.

Leave a Reply

Want to join the discussion?Feel free to contribute!