“The myWorld shareholder is, in fact, being involved with their own capital” – What the “fake shareholder” should talk about with his upline.

Many of the Lyconet marketers waited for almost two days at the “Sensation” in Gelsenkirchen on July 7th & 8th, 2023 for the big IPO. Finally, Hubert Freidl announced within 3 minutes and 20 seconds “As of now you are all shareholders” which could also mean “I screwed you up yet again!”

Since this event, marketers have split into two camps. Into those who only needed the final proof of having been screwed and those who don’t have the slightest idea of how an IPO works and cheered the community on once again.

Even if we are attacked by so-called top leaders, none of the self-described stock market experts around myWorld can or want to argue against the facts stated below.

Because the following is simply facts, which is easy to see if you take a good look at the agreements and T&C’s and don’t believe everything your upline says:

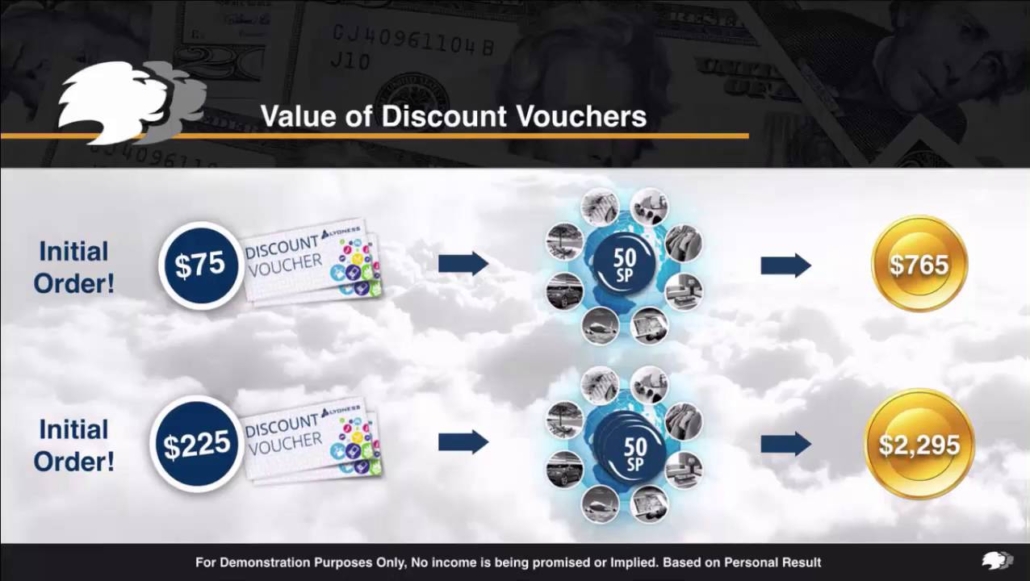

In June 2018, it all started with the Enterprise Cloud program: marketers were to convert their Customer Clouds into Enterprise Cloud 1 with an upcharge of one-third of the value of each cloud. This Enterprise Cloud 1 deal was pushed to investors because they could now engage in the revenue of not just customers in certain countries, but globally. To motivate this conversion, the upcharge to Enterprise Cloud 1 was “rewarded” with double SP. It was also conveyed that the old Customer Clouds would lose their value.

The background, however, is that Lyoness Europe AG did not want to distribute the customer clouds or pay back the invested capital. With the imposed Enterprise Cloud deal and the promise that the investors would now even participate in the worldwide purchase revenues, it was able to get the majority of the investors to convert their Clouds, whereby they even received further payments for the “upgrade” and was able to keep the money for another 4 years, until October 2022, just when Enterprise Cloud 1 should have started distributing. In parallel, it could continue to gain the payments of € 50.00 per month required for the right of disposal. This is how Lyoness Europe AG has always handled it: instead of paying out the promised profits and repaying the invested capital, it always created new fantasy products that were even better and more advantageous and with which one could compensate for their losses. After all, except for recruitment commissions, marketers could not gain any profits within this system.

According to the FAQ for the myWorld Share Program, the member receives myWorld Share Points (mSP) for all previous orders (Discount Voucher, mVoucher, Benefit Voucher), and 1 euro order value corresponds to one mSP. With the conversion, all investments were also credited to the member account, the Shopping Points granted for them were shown as myWorld Share Points, and the purchased clouds were transferred to the new myWorld Share Cloud. The myWorld Share Points were intended to entitle members to shares in the Group’s planned IPO.

The discount vouchers have now become mVouchers, although apart from the slightly similar name, there is no difference at all. The additional conditions for discount vouchers 2017 and the additional conditions for the purchase of mVouchers 2019 are identical in content. So, it seems that all the PB Clouds and payments for discount vouchers still purchased from Lyoness Europe AG appear.

These facts are clear evidence that a contract takeover took place because the Discount Vouchers are distributed exclusively by Lyoness Europe AG and the mVouchers exclusively by myWorld Austria GmbH. Since the contractual relationship with Lyoness Europe AG was dissolved and was taken over by Lyconet Austria GmbH and myWorld Austria GmbH, the Discount Vouchers that were taken over inevitably had to be converted or renamed to mVouchers.

Although it was promised beforehand by Hubert Freidl himself, in all advertising mails and in the FAQ’s to be accepted during the changeover and in the Fact Sheet for the myWorld Share Program, that all orders would be taken over, Lyconet and myWorld denied this fact in the proceedings before the District Court for Commercial Matters Vienna to 9 C 234/2023k. Thus, it is obvious that the members who made the switch to the myWorld Share Program were presumably deceived.

In all advertising measures, the impression was deliberately created that members would receive shares in the share program “completely free of charge” for all bookings (“I have a gift for you!”) and that they would receive shares as a gift for all their payments made to date.

However, participation in the share program is not free at all; instead, investors are required to make minimum monthly payments, as they have been in the past. As with Enterprise Clouds, members must be active, which means they must make at least one monthly product order, because otherwise no distributions from the myWorld Share Cloud are possible.

The fact sheet for the myWorld Share Program states!

Requirements for receiving CP from the myWorld Share Cloud:

“To receive CP from the myWorld Share Cloud, marketers must have been active for a certain period. A marketer is considered active if he or she has placed at least one monthly product order.”

These ‘products’ are, worthless vouchers (Benefit Vouchers, Shopping Point Packs) because, according to the T&Cs of Purchasing and Ordering and Terms of Use of myWorld Benefit Vouchers and the T&Cs of Purchasing and Ordering and Terms of Use of Shopping Point Packs, they cannot be used to make purchases at all.

Instead of Shopping Points (SP), Career Points (CP) are now traded. A Benefit Voucher costs at least € 49.00, so at least € 49.00 per month must still be paid into the system to be entitled to those shares. The higher the payment, the more CP is generated and therefore the profit should be higher, because the compensation is calculated based on the CP.

As it has now turned out, the propagated IPO was just a marketing lie to induce gullible investors to make the switch, so that they forgo their enterprise clouds in favor of mSP. The promised listed shares do not exist at all and the myWorld Share Points have no value at all, so that the money of the marketers is obviously seeping away in the fundraising model of Lyconet and myWorld without any consideration, and a total loss is being suffered.

Contrary to the announcements, no quoted shares are issued, but only registered shares with restricted transferability of myWorld International AG; there is no secondary market at all.

In addition, the documents (FAQ and Fact Sheet for the myWorld Share Program) promise that the members can freely sell 50% of the shares. However, it turns out that the sale is only allowed with the consent of myWorld International AG.

Since the registered shares with restricted transferability may only be sold with the consent of myWorld International AG, the capital is still tied up and even in the event of a total loss, the “shareholder” has no claim to reimbursement, or at least that seems to be the plan!

Plus: it was kept secret for a long time from which group the investors were to receive their shares, especially since in all documents only “myWorld International” was mentioned.

Finally, it was revealed that shares of myWorld International AG were to be received. At the extraordinary shareholders’ meeting on May 26th, 2023, myWorld 360 AG (FN 389134g, formerly Lyoness Cashback AG, Lyoness Group AG, mWS myWorld Solutions AG) was renamed myWorld International AG. Subsequently, a capital increase from originally € 100,000.00 to € 12,000,000.00 was successively agreed upon. Since this capital does not originate from a real business activity, it is presumably the money of the investors, which was distributed via various channels from Lyoness Europe AG first to myWorld Austria GmbH and then to myWorld 360 AG. In effect, the investors will be involved with their own capital, but most of this has probably already been consumed by the leadership.

The conversion to the myWorld Share Program was the final scam to protect themselves in the best possible way against claims in the event of a total loss. The myWorld Share Program is used by those who have already been reported to the Federal Public Prosecutor’s Office for White‐Collar Crime and Corruption, exclusively to trick unsuspecting investors and to enrich themselves unlawfully.

The decision-makers at Lyconet and myWorld apparently created a cunning construct to trick the investors out of their money, to take over the well-paying members of Lyoness Europe AG and to urge them to switch to new contractual partners. They thereby created, among the investors, the now disputed impression that their contractual relationship, along with all previously made investments, would be assumed by the new contracting parties.

Despite promises to the contrary, the parties responsible now claim in bad faith that they are neither liable for the previous payments to Lyoness Europe AG nor that they have anything to do with Lyoness.

Instead of constantly criticizing us for the clarification, those responsible should explain these facts. In recent years, they have often been invited by TV stations such as ORF, ZDF, 3Sat to explain themselves, but they have never complied.

Shame on you, leaders!

Even in court, experts were always named as witnesses, but they never actually appeared. They are stalling for time and when the judge has had enough, they simply withdraw the lawsuit.

That’s the way it’s always been, isn’t it, Mr. Freidl?

Leave a Reply

Want to join the discussion?Feel free to contribute!