Registered shares with restricted transferability and myWorld International AG as issuer? How is that supposed to work?

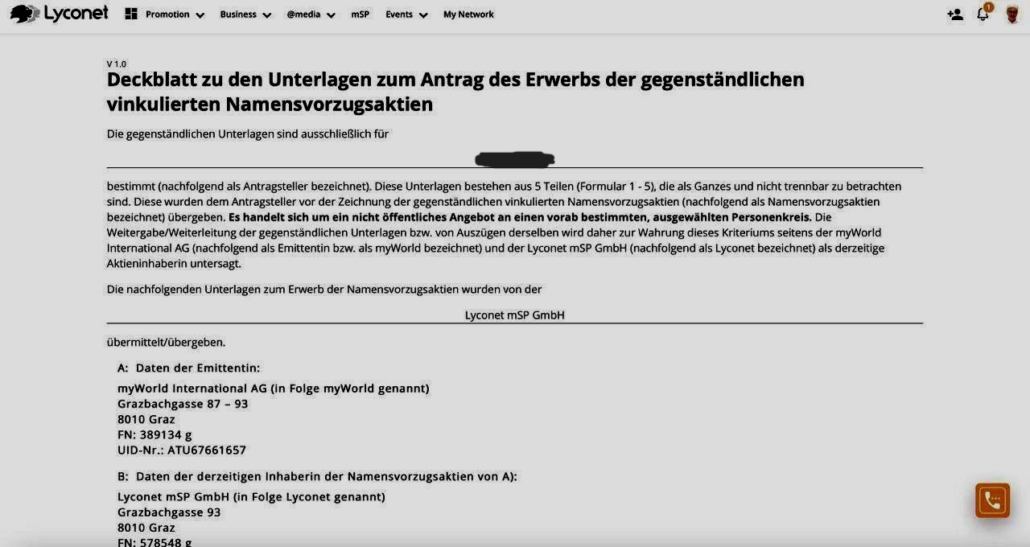

Finally, there is an issuer with a name that claims to want to go public: myWorld International AG, Grazbachgasse 87 -93, 8010 Graz, FN: 389134g.

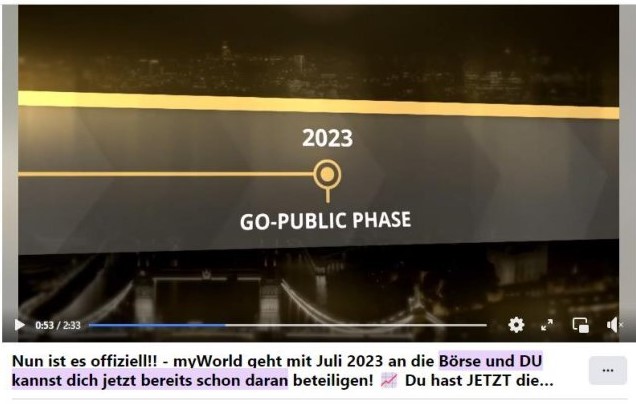

But where is the stock exchange admission, the ISIN (WKN or securities identification number has become obsolete and was replaced on April 22nd by the ISIN, International Security Identification Number). The information at what price and where the share is to be traded is still owed to the members.

Currently, one can view the application for the acquisition of registered preference shares with restricted transferability:

Before we take a look at restricted registered preferred shares, let’s take a look at the issuer itself:

So, the myWorld International AG wants to go public, but who really believes that? After having had the balance sheets of the last three years examined and evaluated by expert lawyers, we have our reasonable doubts. The fact of the matter is that myWorld International AG was previously Lyoness Cashback AG, then Lyoness Groupe AG, then mWS myWorld Solutions AG and finally myWorld 360 AG. The current commercial register excerpt and last published balance sheet can be found directly here:

The official stock exchange rules state the following regarding the process: “Before admitting a security to the Official Market or Regulated Market, the Admission Board for Securities checks, on the basis of the Stock Exchange Act and the Stock Exchange Admission Regulation, whether the issuer and the securities meet the admission requirements.” But where can the admission or the application be found?

There seems to be a great effort being made to get the members who no longer want to participate in the IPO and are waiting for the distribution of their Cloud investments to agree to the new terms.

So, what does the “shareholder” get at the EliteClub seminar on July 7th& 8th 2023?

Aren’t we supposed to be in the Go-public phase? So where is the required securities prospectus/share prospectus, please? Do members really think they will make money on their shares after July 2023 or that they will be traded anywhere? Highly unlikely! Again, the good Lyconet samaritans are supposed to wait for years.

Please wake up!!!

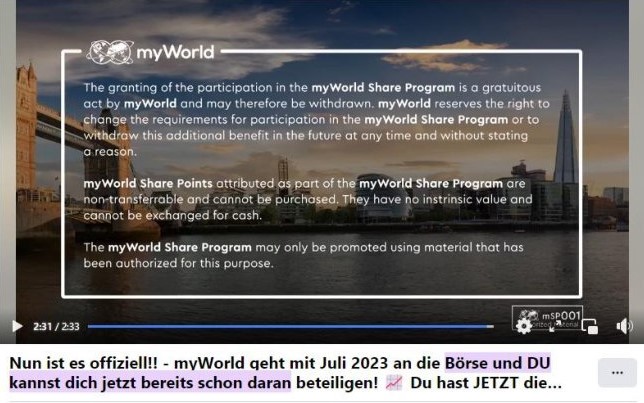

Stocks or just company shares? Registered shares that later become company shares? If one reads the disclaimer of myWorld, only the latter option remains, IPO or not. And that is exactly where the journey will lead us unfortunately, my dear members.

In addition, registered shares with restricted transferability have a number of “special features”, especially for a company like myWorld International AG.

The registered share with restricted transferability is a special form of registered share. The owner is recorded in the share register, but if a registered share with restricted transferability is to be sold, the consent of the corporation is required. Unless otherwise decided in the Articles of Association, the Board of Management of a corporation votes on the transfer. The transfer can therefore be rejected by the corporation. Plus: can someone finally let us know where this IPO is to take place?

The corporation is liable with its corporate assets. The shareholders are obliged to pay the contributions they have made. Additionally, the articles of association may include further obligations. The Articles of Incorporation of myWorld International AG should therefore be read very carefully regarding liability, especially if the shares become company shares after all and one is to be considered a shareholder!

For private investors and investing companies, it can be a disadvantage if shares are not allowed to be traded at the time it would make economic sense.

The public limited company is able to ensure that all sales of shares are blocked by means of registered shares with restricted transferability – even if one would like to sell the shares at a profit, one remains stuck with them due to regulation.

Appropriately, the “wheel of changing names” has been turning again in London, more on this in the upcoming article

Leave a Reply

Want to join the discussion?Feel free to contribute!