Marketers’ concerns about the IPO in July!

The saga of Lyoness/Lyconet/myWorld’s questionable IPO continues: former top leader Teresa Berger mentions the possible scam on her Instagram page indirectly. Internal chat messages reveal that the marketers are concerned about their investments after putting money in time and time again, without seeing any returns. The concerns are not entirely unwarranted. It was announced that an expansion in Asia will take place but on which stock exchange the current company will be listed, the WKN or IPO number and stockprice are still unknown. The only information available is that an Upper Austrian company is said to have taken over the valuation and support. Deloitte, perhaps? Well, Deloitte has already publicly denied their involvement.

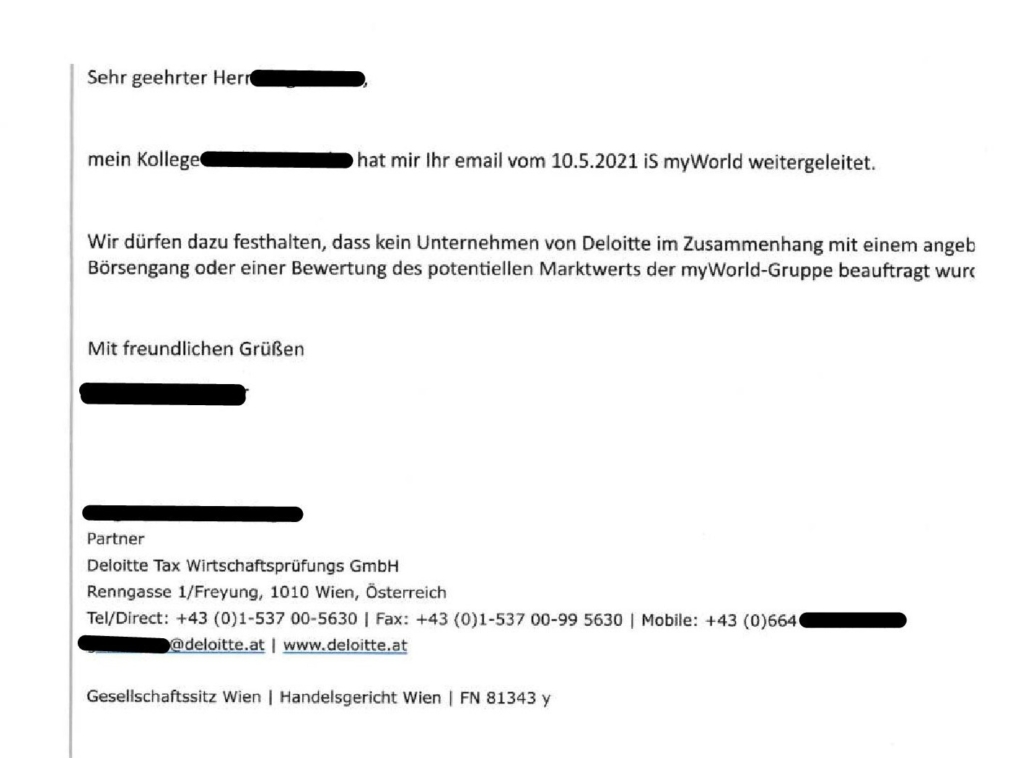

Translation: mail from Deloitte’s denial:

Dear Mr…

my colleague has forwarded me your email dated 10th of May 2021 iS myWorld.

We would like to state that Deloitte has not been engaged in connection with an IPO or an assessment of the potential market value of the myWorld Group.

Yours sincerely

Deloitte Tax Wirtschaftsprüfungs GmbH

The marketers’ fears are not taken seriously, and the supposed listed company pretends that the most important questions that are currently being asked are considered insider information, although it should be public knowledge by now. The company allegedly claimed to marketers in the past that it would be listed on NASDAQ, but it has not yet been made public at what price and on which exchange the stock will be traded. Normally, such information would have been available to the public a long time ago, especially since the IPO is scheduled for the beginning of July.

Translation of the chat on the right:

“The IPO is now within close reach. By now we should know where it will be listed, shouldn’t we? Can anyone answer this question for me? Thanks in advance”

“Deloitte is not an exchange. The latest information will probably be available at the Elite Seminar.”

1. things change – thank goodness, otherwise we’d still be knocking stones.

2. the assessment / monitoring was done by an Upper Austrian company.

3. the company certainly knows where/when/what/how it will be listed, but certain information is not spread as “rumors “, but is officially distributed as a newsletter and – I assume – also officially launched at the Elite Seminar; just as it is with any big and important information.

“Believe me, no one wants to believe in this as much as I do. It’s not that easy though.”

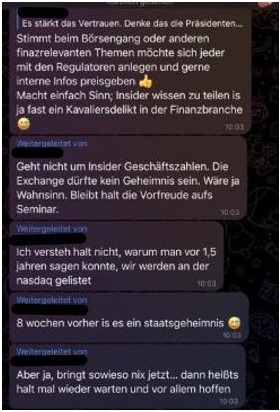

Translation of the chat left:

“It’s true that when it comes to IPOs or other financially relevant topics, everyone wants to mess with the regulators and gladly disclose internal information. It just makes sense; sharing insider knowledge is almost a trivial offence in the financial sector. (sarcasm)”

“It’s not about insider business. The exchange should not be a secret, that would be insane. What remains is the anticipation of the seminar.”

“I just don’t understand why they could say 1.5 years ago that it would be listed on NASDAQ.”

“8 weeks before, it’s a state secret.”

“But yes, it doesn’t matter anymore now… it’s just a case of waiting and hoping again.”

Ex-marketers Teresa Berger and Nikolaus Krause have since moved on to another company and she currently expressed her mistrust visibly on Instagram, Berger takes a dig at Lyoness/Lyconet by posting a mocking meme regarding the “cloud distributions” that have not taken place to this date. It is likely that marketers will have to hold out again and that Gelsenkirchen will announce that the company will go public in Asia in the future. This further intensifies marketers’ doubts and concerns so close to the upcoming event. These legitimate questions should not simply be brushed aside.

However, the possible upcoming announcement that the company will go public in Asia raises additional questions. Why will the IPO not take place on NASDAQ as announced?

Every member should take the opportunity to get information online, by simply entering “IPO process” into any search engine and comprehending the given information.

These bullet points should have been fulfilled by Hubert Freidl and Lyoness/Lyconet/myWorld for a while now and the information should have been published.

Why is there still no solid information on the price of the share and on which stock exchange it will be traded? Marketers have the right to clarity and transparency. The indications so far suggest that, as usual, something is not right. Or is the elite seminar in Gelsenkirchen just a pretty “certificate” stating that marketers now own some stake in some company.

It is time for the company to provide answers to avoid further speculation and rumors.

Leave a Reply

Want to join the discussion?Feel free to contribute!