Mr Hubert Freidl, where are the cloud payouts this time?

Over the past year, Lyconet presidents have been under pressure, since they overpromised and underdelivered, yet again. The cloud solutions promoted around five years ago are being brushed over now that they should be generating dividends, while Lyoness/Lyconet focuses on its new compensation plans, the myWorld-Share-Program and the IPO. But slowly and surely, even the most loyal marketers start to question their decisions: internal chat groups reveal that resentment and disbelief are increasing amongst the members – poison for every multi-level marketing concept.

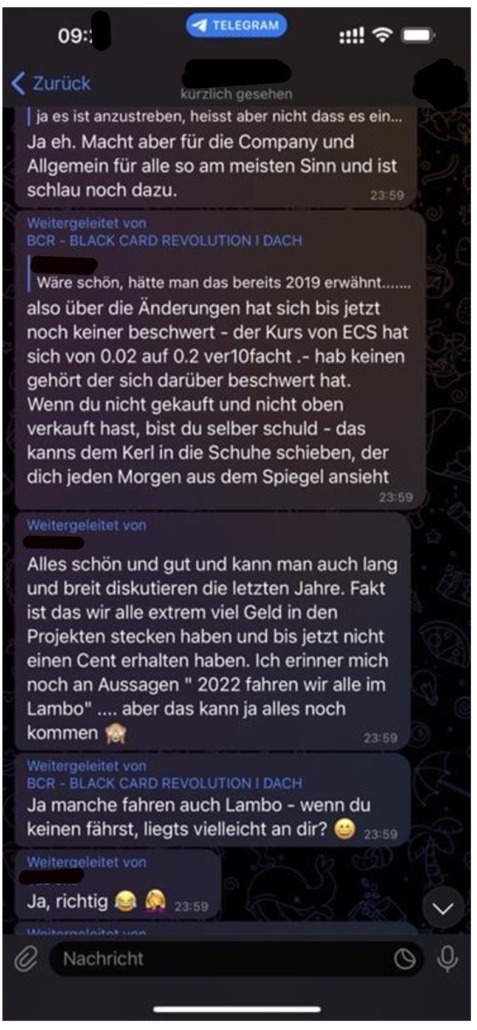

Despite, Lyconet-presidents act calm and collected while replying to questions in their usual annoyed manner all while emphasizing personal responsibility and using the pandemic as an excuse.

Although e-commerce and online based businesses were able to increase their turnover by up to 70% during the pandemic, apparently, Hubert Freidl’s companies were not among the winners, probably because the cloud solution payouts never even worked to begin with.

Which reinforces the members’ doubt that their investment would pay off in the first place. Recent chat histories revealed that at the beginning of their cloud careers, marketers were led to believe that they

“would be driving Lamborghinis by the year 2022“.

Even former top marketer A. Matuska admitted that he sold his Lambo and then regularly borrowed the same car for videos and promotions because the maintenance costs were simply too high. The doubts about whether it is even possible to make money as a network marketer for LYONESS/LYCONET are more than justified and are steadily increasing.

So what will become of the marketers’ cloud investments? The existing compensation plans have been replaced by the “share program”, which has been running since 2021 and is to be implemented during the promised IPO this summer. In the “preparation phase” of the program, marketers can generate purchase volume by buying discount vouchers that can be redeemed on the website. The current promise is that in the “go public phase”, these volumes can then be redeemed free of charge for previously announced shares in the quote on quote “billion-dollar company”.

How much longer will Hubert Freidl be able hold out, in case the IPO does not take place as promised while keeping his companies up and running despite several legal disputes in various countries? Whether or not everything Hubert Freidl has built over the last years will eventually collapse like a house of cards will likely be decided this summer.

Leave a Reply

Want to join the discussion?Feel free to contribute!