Lyconet has announced: There will be no IPO as previously stated!

Ex-marketer Nicolas Krause: “There will never be an IPO”!

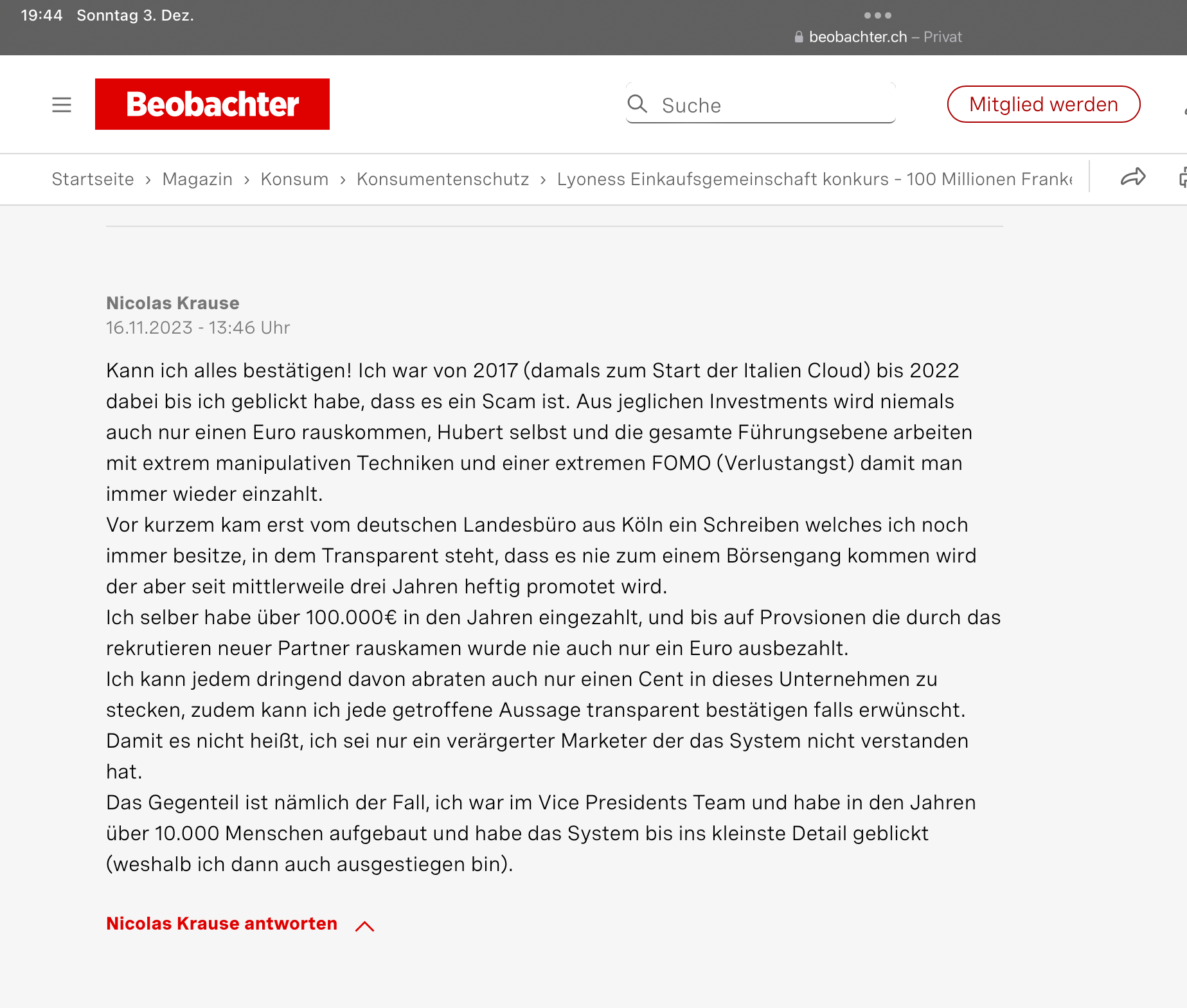

The former Vice President team member of Hubert Freidl’s Lyconet/myWorld, released his marketers into self-employment with a video and distanced himself from Lyconet for months, after the event in Gelsenkirchen. Surprisingly, he commented in the Swiss business journal BEOBACHTER.

Lyoness Einkaufsgemeinschaft konkurs – 100 Millionen Franken Schulden | Beobachter

Translation: Nicolas Krause

16th Nov 2023 – 1:46pm

I can confirm everything! I was involved from 2017 (back when the Italy Cloud started) until 2022 when I realized it was a scam. Not a single euro will ever come out of any investments. Hubert himself and the entire leadership team operate using extremely manipulative techniques and an intense FOMO (fear of missing out) to make people keep depositing money.

Recently, I received a letter from the German headquarters in Cologne, which I still have, stating clearly that there will never be an IPO, despite heavy promotion for the last three years.

I personally deposited over €100,000 throughout the years, and apart from commissions gained by recruiting new partners, not a single euro was ever paid out.

I strongly advise everyone against investing even a single cent in this company. Additionally, I can transparently confirm any statement made if desired. So, it’s not just the frustration of a marketer who didn’t understand the system.

Quite the opposite, in fact. I was part of the Vice Presidents Team, gathering over 10,000 members within those years and understood the system down to the smallest detail, which is precisely why I decided leave.

He openly admits what many insiders and victims have known for years.

You cannot earn money with Lyoness/Lyconet/myWorld. He himself claims to have deposited over 100,000 euros over the years, and apart from the commissions paid out through recruiting new partners, not a single euro has actually been paid out.

From the start, our CEO Ben Ecker predicted that there would be no IPO and no “listing on stock exchanges,” despite Hubert Freidl having declared his marketers as “shareholders” at the Lyconet event in Gelsenkirchen last July.

“…recently, a letter came, which I still possess, clearly stating that there will never be an IPO, despite it being heavily promoted for three years now,” Krause stated.

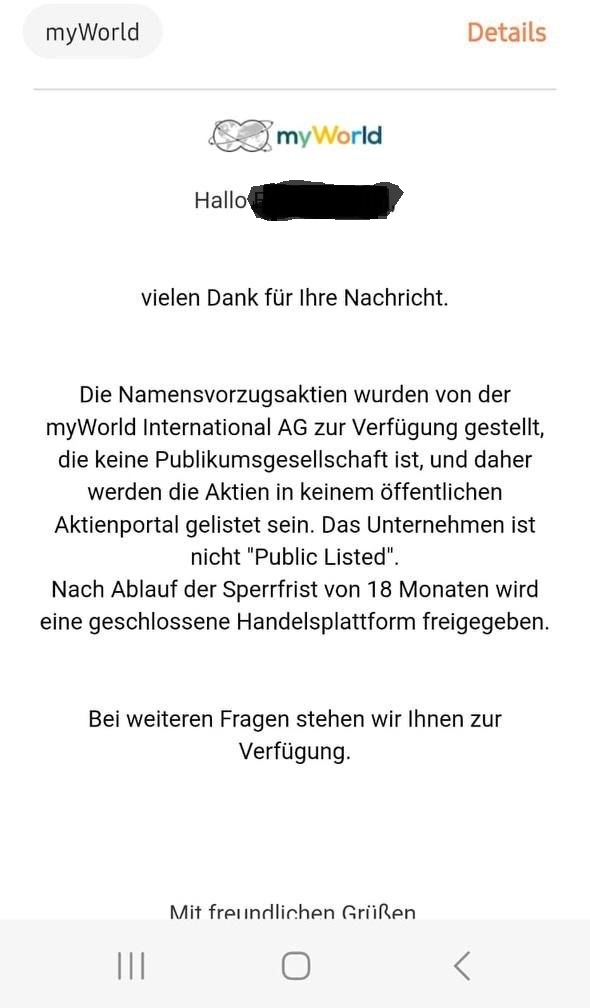

Additionally, myWorld/Lyconet themselves wrote to a marketer:

Translation:

Hello,

Thank you for your message.

The preference shares were provided by myWorld International AG, which is not a public company, hence these shares will not be listed on any public stock portal. The company is not “Public Listed”.

Following the expiry of the 18-month lock-up period, a closed trading platform will be made available.

Should you have any further questions, feel free to reach out to us.

One truly cannot make this up, Nicolas Krause talks about manipulative tactics and working with FOMO (Fear Of Missing Out) to recruit marketers and persuade them to continue investing, as if he himself hadn’t been at the forefront for years and admittedly earned his money by referring new paying marketers.

How and why else would he have built a network of reportedly 10,000 people over the years?

Krause exited immediately after the Gelsenkirchen event and continues to work in the MLM sector, most recently with his former Lyconet colleague Teresa Berger.

Nevertheless, the insider information he possesses could still be of significance, especially as the Lyoness/Lyconet/myWorld system is being looked at more closely by an increasing number of associations and authorities.

Hopefully, his belated honesty online won’t harm him retrospectively because even though he separated from the company, he profited for years from people who were not as close to the upline as he was.

He has indeed accurately analyzed the IPO situation because Hubert Freidl’s “stocks” can only be traded on an internal platform where marketers can essentially buy and sell their shares to each other.

Those fortunate enough to find someone gullible enough to buy these worthless stock certificates can consider themselves lucky. However, the internal closed trading makes no sense at all since everything will be entirely without value.

And officially, there will not be any trading on a regulated market, as it was marketed for three years.

The funds deposited cannot officially be reclaimed as marketers have unknowingly or not relinquished their rights without compensation. As seen with previous models, the cash flow from investors into the Freidl system is a one-way street.

With the lock-up period, investor capital remains stagnant for another 18 months, as previously seen with country packs or Cloud as Freidl can come up with his next promises.

Leave a Reply

Want to join the discussion?Feel free to contribute!