Harald Seiz presents his next endeavor: The Minebase Webinar

On September 25th, 2023, the founder of Karatbars, now Minebase.com, Harald Seiz, makes a public appearance in an online webinar to promote his new cryptocurrency scheme. Within the first minutes of the webinar, Seiz attempts to sell cryptocurrency as “the future” claiming there are currently over 3,000 digital currencies. In November 2019, the BaFin (Federal Financial Supervisory Authority) issued a cease and desist order against the Karatbit Foundation, based in Belize, to immediately cease its unauthorized e-money business operations in Germany. According to reports from German economic media, investors are said to have suffered a total of 100 million euros in damages.

In the webinar, Harald Seiz attempts to persuade his audience that his new crypto business, Minebase.com, is not susceptible to manipulation. He procures potential investors through fearmongering and claims that fiat currencies will eventually become worthless. He makes the preposterous claim that due to current inflation; fiat currencies are now worth only 10% of their value worldwide.

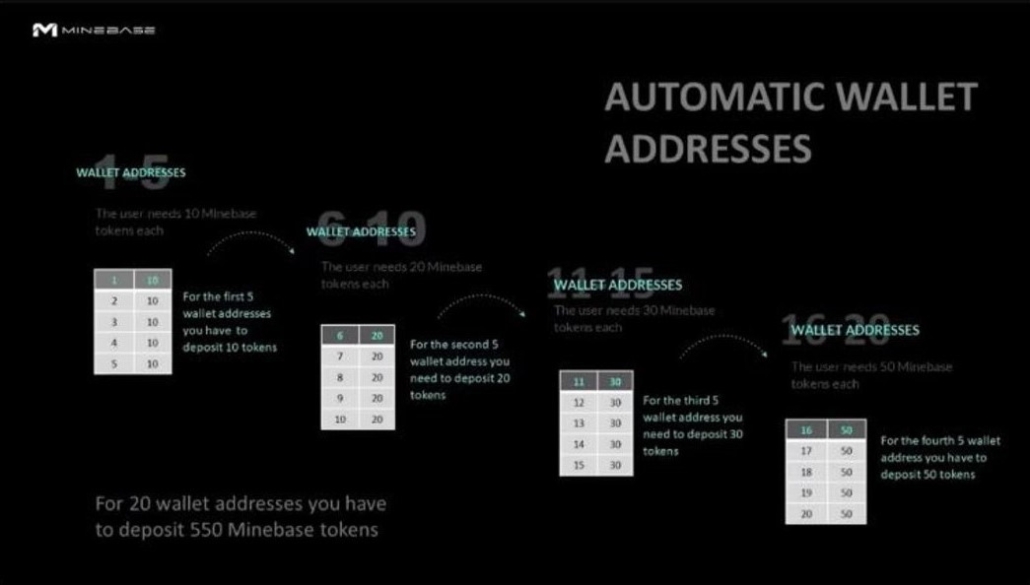

Additionally, Seiz refers to his so-called Minebase tokens as the world’s financial solution and claims that the so-called tokens are generated by an exclusive smart contract. He then introduces his system called “Creative Token Production” (CTP) and the “Blocktrade Protocol Fee Tracker Software” (BPFT), which is supposedly engineered to create Minebase tokens. Following this, Harald Seiz presents what he believes to be the creation and exchange prices of the so-called currency and attempts to entice potential investors by presenting a value increase based on foundationless speculation, claiming that it would go from $6.50 to $793,000.00. The system relies upon ongoing electronic wallet deposits in order to generate revenue.

Seiz encourages potential investors to create multiple wallets and make numerous deposits that allegedly act to disguise the true monetary values funding the system. After the first 12 minutes of presenting the exchange of actual currency to his fictitious currency Seiz presents a video holding out various levels of commissions in-conjunction within the levels of the very opaque Minebase Compensation Plan. Participation in the Minebase system ranges from $100.00 to $5,000.00, and participants are induced into purchasing larger packages to gain access to greater commissions.

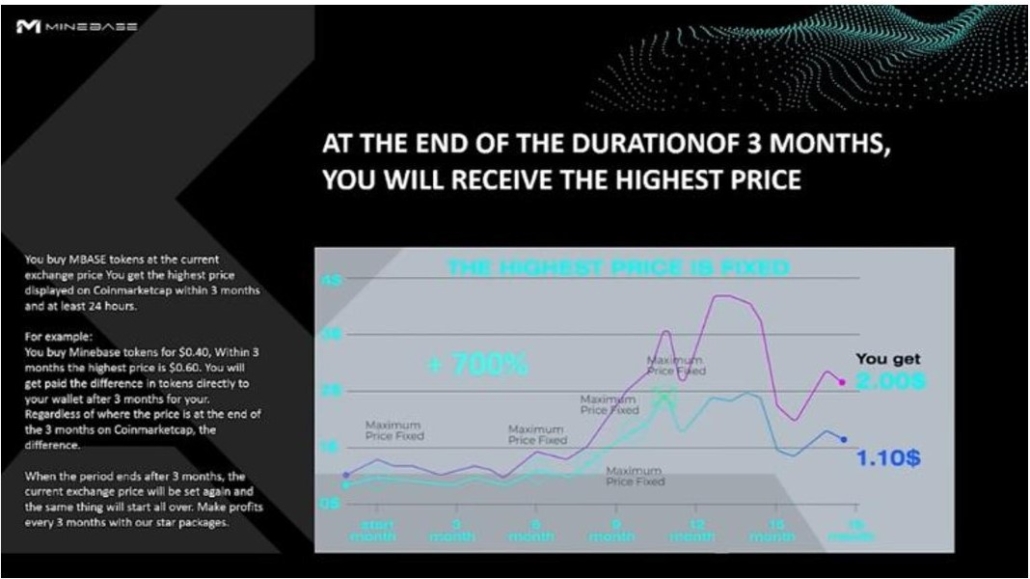

Furthermore, he does not present any worthy investment, speculates the increase in value of the minebase tokens and promises returns every 3 months but on what real investment? Money is paid into the scheme, and commissions are paid out of the system, therefore the investors’ money has decreased in value from the outset. Seiz fails to provide any merit to substantiate the rise in value of deposits and claims that the token price is fixed. Moreover, he claims that the so-called token can return up to 700%. How could this be possible when the value of deposits must decrease as commissions are paid to upline marketers?

Harald Seiz then introduces his brand ambassador, “Jimmy Larsen.” Larsen claims that the Minebase compensation plan represents a global opportunity then proceeds to attempt to sell various empty packages ranging from $100 to $5,000, which qualifies individuals for different commissions within the compensation plan. Minebase is not registered or licensed in numerous countries, therefore could not be considered a lawful global entity. Larsen’s role in the company seems to be focused on recruitment and training. There is no real product offering, no real investment, and no service – the only revenue possibility comes from commissions derived through recruitment of further victims into the scheme.

In the closing statements Harold Seiz holds out a 90-day action plan doubling the commissions within the compensation plan, this only reinforces that the deposits paid into the system are further devalued when commissions are paid to upline marketers, investors and participants in the scheme.

IN CONCLUSION

Harold Seiz claims that the minebase tokens would eventually be worth a significant amount of money .The “Minebase tokens” are essentially worthless and are likely to lead to further financial losses for investors and marketers. It is a misleading to call a deposit into a digital system a cryto currency, the conversion of real money (fiat) to digits within the back office of a website is not a currency by any economic definition, if anything it is an unregistered / unlicensed security, no real investment exists and when commissions are paid to upline marketers investments instantly lose value. If anything, it is an unregistered, unlicensed security, no real investment exists and when commissions are paid to upline marketers’ investments instantly lose value.

Further deception lies in the terminology used, coins, tokens or whatever nonsense words that are used to attach to lines of code stored on ledgers called blockchains in an attempt to convey legitimacy or technological sophistication. The Minebase system relies upon payments being paid into the scheme that inherently lose value the moment commissions are paid to upline marketers.Seiz seeks to find vulnerable parties presenting the financial narrative of mistrust within the regulated financial system and proclaims that his Minebase system can be the future of money and create wealth.Each claim is unsubstantiated and the system without any provable real investment taking place is unsustainable.

WARNING

Minebase appears to operate a financial services business in a manner that is likely to attract unsuspecting consumers into investing in its “financial services.” However, it is not licensed in many countries where the system is promoted, meaning customers are not protected by regulatory authorities. The promised returns by Minebase are unrealistic, and consumers should treat unusually high returns with extreme caution. While Minebase accepts crypto assets as payment, it is not registered as a company, which means consumers do not have the same protections as they would when dealing with registered companies or paying through other means, such as bank transfers. Minebase encourages marketers to recruit new investors into the system. This is a classic sign of a pyramid scheme and appears not to represent a genuine investment. Allegedly, commissions are paid from investments, which is another characteristic of a Ponzi scheme.

We invite injured parties to contact us at BE Conflict Management.

Leave a Reply

Want to join the discussion?Feel free to contribute!