Hobby or Business? Why Promoters at XPRO, VOO & Co. Can Walk Straight Into a Tax Trap

“Crypto is the future!” – “Join the revolution!” The promises are bold, and the presentations are full of hype. But behind many of these sales models – whether it’s XPRO, VOO, or Copper.One – lurks an invisible danger: tax law. More specifically, the concept of “hobby activity” (known as Liebhaberei in German-speaking tax systems).

What Is “Liebhaberei” in Tax Law?

In Austria (as in many other countries), the tax office examines whether an activity is genuinely pursued with the intent to generate profit. If that intent isn’t clearly demonstrable, the activity is classified as a hobby – and becomes tax-irrelevant.

The Consequences?

- Losses cannot be claimed for tax purposes.

- Profits, however, may still be taxable.

- VAT deductions may be denied – and refunds could be reclaimed.

- The entire business model is deemed privately motivated – with no tax advantages.

What Many Don’t Realize:

Initial losses – so-called “start-up losses” – are only accepted by the tax office for the first few years. But only if it is credibly demonstrated that a total profit is realistically expected over time. And that’s where the problem begins.

XPRO, VOO & Co.: Between Promise and Reality

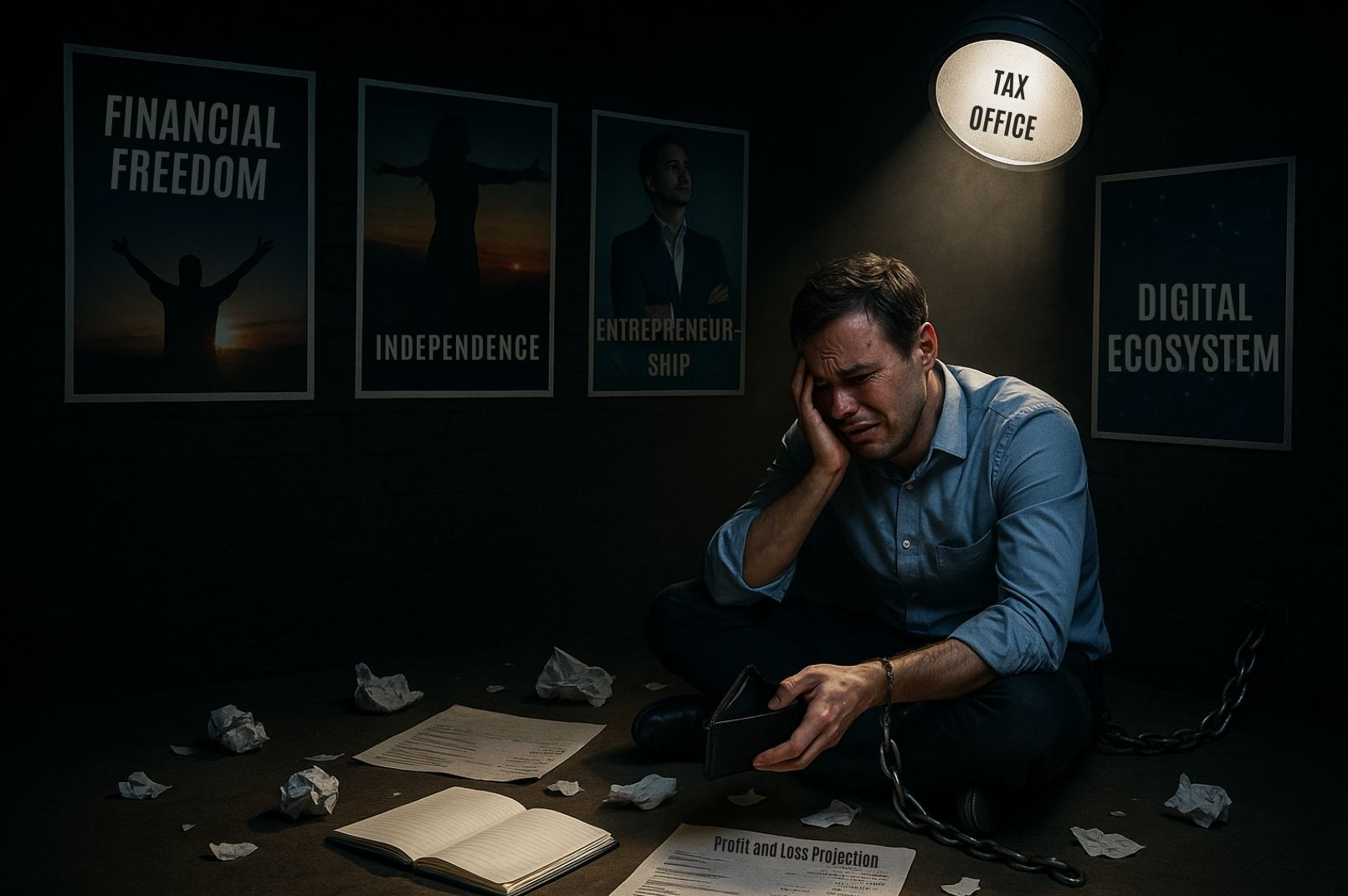

Ponzi schemes like XPRO, VOO, or Copper.One operate using multi-level marketing structures. The promises are grand: those who put in the work can supposedly achieve “financial freedom” through commissions. But behind the scenes, there’s often nothing more than a dependent structure that carries serious tax risks.

Why?

- Most promoters fail to generate sustainable profits.

- Income is derived almost exclusively from one’s downline.

- There is no real business plan – just motivational Zoom calls.

- Business expenses such as travel, equipment, or events are claimed despite the lack of recurring income.

That doesn’t cut it for the tax office: anyone who reports losses year after year without a clear strategy or credible profit forecast will see their activity classified as hobby activity for tax purposes.

Now It Gets Uncomfortable

Many in the lower tiers of the structure work unpaid for the system. They invest time, money, and energy into what they believe is self-employment – while profits are skimmed off at the top. That’s not entrepreneurship; it’s exploitation.

It’s portrayed as being part of a “digital ecosystem.” In reality, many are simply an extension of a centralized sales machine – without legal or tax security. No accounting, no planning, no profit intent – but plenty of tax risk.

What the Tax Office Wants to See:

- A written profit forecast (over approx. 5–10 years) demonstrating expected profitability.

- A transparent and credible business structure.

- Concrete measures to increase efficiency, expand the market, and target strategic customer groups.

- A clear separation of personal and business activities.

If this is missing? Then what many call their “business” will be unmasked by the state as a private hobby.

The Final Question with XPRO, VOO & Co.: Who Is Really Free?

There’s a lot of talk about “financial freedom” and independence – but many XPRO and VOO promoters are heading straight for a rude awakening when it comes to taxes. No legal protection, no entrepreneurial safety net, no sustainable structure.

The only thing truly “free” here is the money flowing to the top of the pyramid.

Anyone promoting these systems should be aware: not everything that shines on stage can withstand a tax audit. And the slogan “Be your own boss” becomes a cruel joke when the tax office rules your venture a hobby – and demands repayments.

Note: As always, we welcome responses from those involved. If anyone has additional or differing information, we encourage them to share it with us. Our aim is not to make unfounded claims, but to provide thorough and transparent documentation.

Source: www.bekm.us

Leave a Reply

Want to join the discussion?Feel free to contribute!