From billionaire visionary to tax dodger? Investigators are on the hunt!

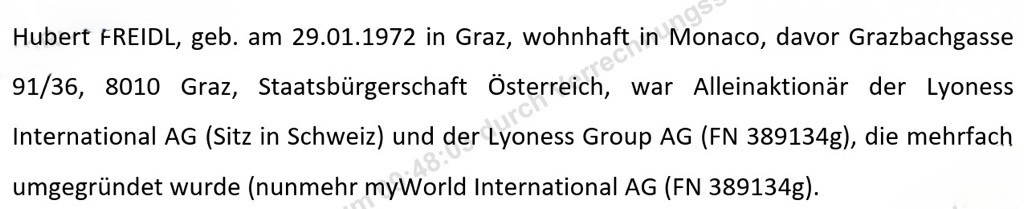

On the outside, he appears to be a visionary entrepreneur – but behind the shiny façade lies a web of concealment, fictitious transactions and alleged tax evasion. The Hubert Freidl case is coming to a dramatic head. The Graz public prosecutor’s office is investigating under file number 16 ST 47/25 g.

Some observers are reminded of the fate of Al Capone, who was also ultimately brought to justice not for his other crimes, but for tax evasion.

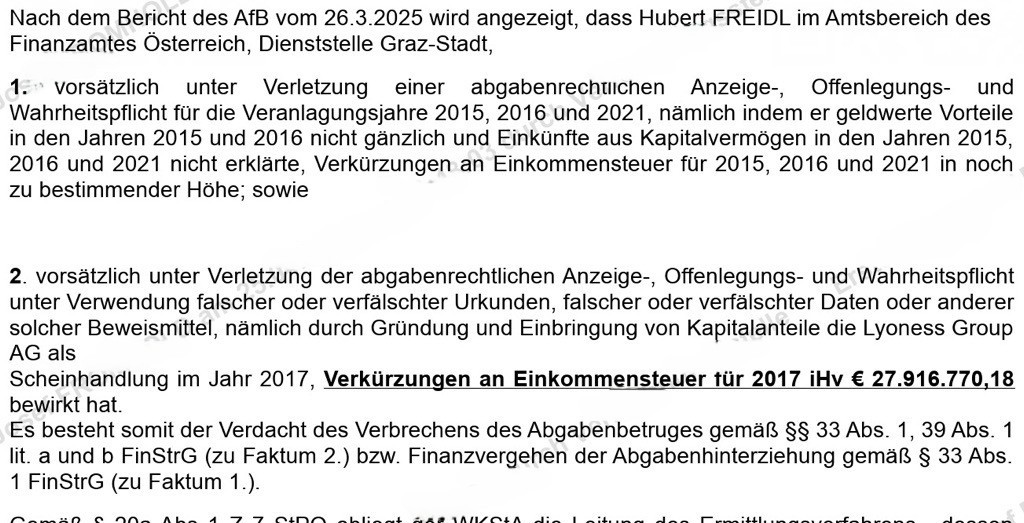

According to an internal report by the Office for Combating Fraud (AfB) dated 26 March 2025, Hubert Freidl, founder of the controversial myWorld system (formerly Lyoness), is under serious suspicion: In 2015, 2016 and 2021, he is alleged to have failed to properly declare income from capital assets and monetary benefits on a significant scale. Particularly serious is the allegation that the contribution of capital shares in Lyoness Group AG in 2017 was merely a sham. The result: an alleged tax reduction of around 27.9 million euros for this year alone.

Fictitious share transactions and undeclared millions

Another controversial issue concerns the alleged sale of shares in myWorld 360 AG in December 2020. The contractually agreed purchase price was 7.2 million euros. However, according to the tax office, no money was paid – instead, deferral agreements were concluded that ran until the end of 2023. The income was not recorded for tax purposes. The result: an additional capital gains tax claim of 1.7 million euros for 2021.

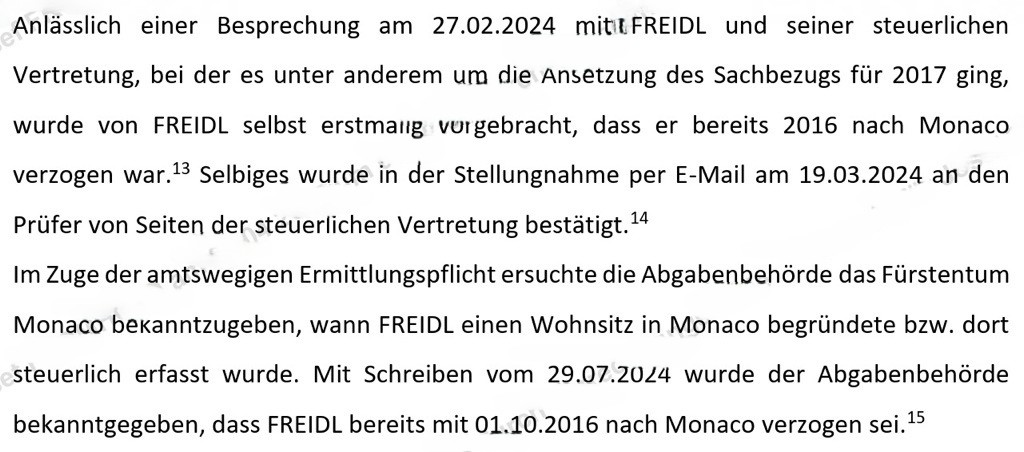

Relocation to Monaco – disclosed too late

Freidl’s move to the tax haven of Monaco also raises questions. Although he stated in a meeting in February 2024 that he had already moved there in 2016, this was not officially reported to the Austrian tax authorities until eight years later, in 2024. However, this tax-relevant fact was not officially reported to the Austrian tax authorities until eight years later, a clear violation of Section 27(6) of the Income Tax Act, which also classifies a move away as a tax-relevant ‘sale’, especially if it restricts Austrian taxation rights.

The consequence: Here, too, capital gains tax of almost 28 million euros should have been assessed, but no declaration was made.

Incomplete information and failure to report

According to the files, Freidl used an apartment free of charge in 2015 and 2016, but only declared part of the monetary benefit. The tax office is also demanding additional payment of around 69,000 euros in income tax for this. Given an officially declared income of around 284,000 euros (2015) and 410,000 euros (2016), these amounts may seem relatively small, but they fit into an overall picture of systematic omission, deception and alleged concealment.

Authorities suspect document manipulation

Particularly serious are the allegations that Freidl deliberately used false or falsified documents and manipulated data to deceive the tax authorities. The sham transaction involving Lyoness Group AG is said to have been deliberately staged to conceal actual tax liability.

Business model under pressure – criticism of the myWorld platform

Parallel to the tax investigations, Freidl’s business models are once again coming under criticism. The promise of ‘passive income’ and ‘financial freedom’ propagated for years is increasingly appearing to be a mirage. In the past, parts of the system have already been classified as an illegal pyramid scheme on several occasions.

The introduction of new 49-euro packages in March 2025 is seen by industry experts as a last-ditch attempt to keep the crumbling system artificially alive. The internal trading platform for myWorld shares is particularly criticised: no dividends, no real tradability, no supervision. A former chief trader at Goldman Sachs commented on the construct with a single word: ‘Bullshit.’

Expansion of investigations – top marketers also in the spotlight

The financial investigations could soon also affect those who marketed the system at the forefront. The often-used defence that they were ‘only sales partners’ is unlikely to hold water in light of the current facts.

The euphoria propagated by many is increasingly proving to be what it apparently is: a last-ditch attempt to save face before the system finally collapses.

From billionaire visionary to tax evader?

As recently as January 2025, Freidl had appeared remorseful at internal events, admitting to management mistakes and communication problems, but he continued to uphold his image as a brilliant entrepreneur. The findings now published paint a different picture once again: that of an entrepreneur who allegedly violated his tax obligations for years, deceived authorities and built his entire business model on shaky foundations.

The Freidl case will occupy the judiciary and the public for a long time to come. The presumption of innocence applies, but the facts are overwhelming.

Note: As always, those affected are welcome to comment, or if anyone has more or different information, they are welcome to share it with us. We are not interested in making false claims and our primary goal remains to provide complete documentation.

This article is based on publicly available information, in particular the report of the Office for Combating Fraud dated 26 March 2025. The presumption of innocence applies.

Leave a Reply

Want to join the discussion?Feel free to contribute!