Copper, Crypto, Charade: Copper.One & the Castle of Grand Promises

From the outside, it all gleams—copper mines, tokenization, glitzy events. But behind Copper.One’s polished PR façade lies a familiar mix of risks and familiar faces from the world of multi-level marketing. A closer look reveals a “value-backed” dream built more on hype than substance.

Copper.One: A Castle, a Coin & a Carefully Crafted Spectacle

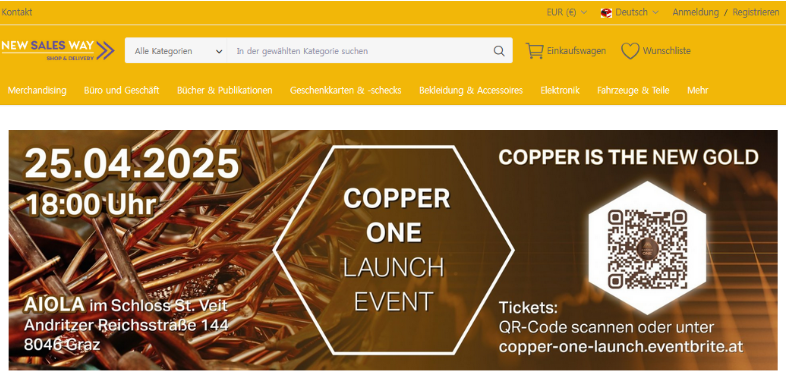

VOO and AVINOC channels have been buzzing with invites: On April 25th, the baroque St. Veit Castle near Graz will set the stage for the latest high-gloss investment pitch. The occasion? The launch of Copper.One. Champagne, dinner, copper coin giveaways—it all screams exclusivity.

At the heart of the presentation is an investment model said to blend copper mining with tokenization and “community involvement.” The pitch includes all the blockchain-era buzzwords: decentralization, real-world assets, the future of finance. In practice, though, it reads more like multi-level marketing with a crypto makeover.

Copper.One Tokens—But Where’s the Copper?

The centerpiece of the venture is the TCu29 token, which is claimed to represent one pound of copper stored in Arizona mines operated by a partner firm, Tempestas Copper Inc. That’s the promise, anyway.

But here’s the catch: the tokens aren’t actually backed by physical copper. Instead, their value is supposedly linked to the future potential of mining operations. Investors are being sold a promise—one with no independent audit, no guarantees, and no proof that any copper will ever be extracted.

Even more telling: the token won’t be tradable until July 2026. Until then, anyone who invests is essentially lending money to Copper.One, locked into a platform controlled solely by the company—without oversight, transparency, or safeguards.

The MLM Playbook: Emotion Over Information

The event is slickly staged: castle setting, time-limited discounts, prize raffles, community bonding moments—it’s all straight out of the MLM playbook. But what’s missing? The usual trappings of a serious financial product: no whitepaper, no technical documentation, no legal clarity.

What’s offered instead is an emotional sell. You’re not just buying a token—you’re “joining a movement.” Of course, you’ll have to commit your capital for 24 months to get in on the deal. There’s even a 30% discount on token purchases—as long as you act fast.

Sound familiar? That’s because it echoes countless other schemes where returns depend not on real-world value, but on a steady flow of new buyers.

“Active Participation”—Or Just Another Way to Pay?

Terms like “value-backed,” “cooperative,” “community,” and “tokenization” are repeated like mantras throughout Copper.One’s marketing—but when it comes to concrete definitions, things get vague fast.

How exactly does “active participation” work? What’s the legal framework? What rights do investors have? The answers are nowhere to be found.

This kind of vagueness is a hallmark of crypto-MLM hybrids, where emotion, exclusivity, and jargon take the place of clarity and compliance.

Copper.One: When Will Regulators Take Notice?

lthough regulatory bodies like BaFin and the FMA have not yet issued an official warning about Copper.One specifically, they have repeatedly classified similar projects as “unauthorized financial services.” Internationally, several financial authorities—such as the Central Bank of Russia—have already placed predecessors of AVINOC/VOO and XPRO, namely Safir/ZENIQ, on their official warning lists.

There is little doubt that Swen Völkl-Schild was also involved in that failed MLM scam. To this day, he continues to sell overpriced ZENIQ-branded merchandise through his “New Sales Way” online shop and remains active in Telegram groups associated with XPRO, the direct successor to the scheme.

Familiar Faces, Familiar Patterns: Swen Völkl-Schild

Among those behind the Copper.One project is Swen Völkl-Schild—a familiar name in the crypto and MLM world. He was previously involved in other similar systems. His presence here signals a rebranding of the same recruitment strategies and sales structure for a new round of potential investors.

The setup is classic: prominent Telegram groups, affiliate commissions, and pressure-driven sales tactics through motivational rhetoric. That Völkl-Schild is now launching a new “value-backed” token project feels less like coincidence and more like calculated repositioning.

Copper.One Conclusion: Polished Promises, Tarnished Truths

Copper.One promises participation in a “new commodity system,” but the facts tell a different story: there is no guaranteed asset backing, no clear regulatory framework, no independent auditing—only elaborate staging, high risks, and familiar figures from the MLM world.

The stage is set—but what’s being sold here is less a revolution in finance and more a polished revival of well-worn tactics. Those who invest are primarily investing trust—into a system that, upon closer inspection, gives little reason to earn it.

For those who prefer to play it safe, it might be wiser to look for copper in their own household—or better yet, leave it in the ground. Sometimes, it pays to be wary of the shine—especially when it masks a mirage.

Note: As always, we welcome responses from those involved. If anyone has additional or differing information, we encourage them to share it with us. Our aim is not to make unfounded claims, but to provide thorough and transparent documentation.

Image sources: Telegram @VOOtravel, AVINOC, Instagram account “New Sales Way”, www.newsalesway.shop, www.facebook.com/reel/1139014740725010

Leave a Reply

Want to join the discussion?Feel free to contribute!