DAO1 and Apertum: crypto promise with deception?

From the outside, DAO1 promises a modern crypto paradise: automated trading bots, mining of its own tokens and passive income opportunities that seemingly guarantee investors financial freedom. But behind the dazzling promises of DAO1 and the Apertum Holding Limited company behind it, there is a questionable web of opacity, legal conflicts and dubious business models.

A company without a legal face

DAO1 presents itself as a ‘decentralised autonomous organisation’ – a term that is familiar in the blockchain world, but here it serves more as a cover. Neither DAO1 nor Apertum Holding Ltd, which is allegedly based in Funchal (Madeira), can be clearly found in relevant commercial registers. According to the information available to date, DAO1 is not an independent legal entity.

Warnings from regulators worldwide

The Financial Market Authority (FMA) has officially warned: DAO1 is not registered as a financial services register, but is nevertheless actively promoting supposedly profitable financial products. The FMA sees significant risks for investors in the promises surrounding automated trading and mining bots, particularly due to the unrealistically high potential returns.

In the US, the Texas State Securities Board (TSSB) has issued a cease-and-desist order against Apertum Holding Ltd. The accusation: illegal, unregistered securities offerings.

More appearance than reality: DAO1 products

DAO1 sells access to ‘trading bots’ and so-called ‘APT mining bots’ for an annual payment of between 50 and 10,000 USDT. In return, users are supposed to be able to make large profits with minimal effort. However, independent evidence of the function or effectiveness of these bots is still lacking.

The offer is supplemented by a classic MLM compensation system: those who recruit new members rise in rank and can allegedly earn millions. Critics speak of a pyramid scheme in which income is generated primarily by new recruits, not by a viable product.

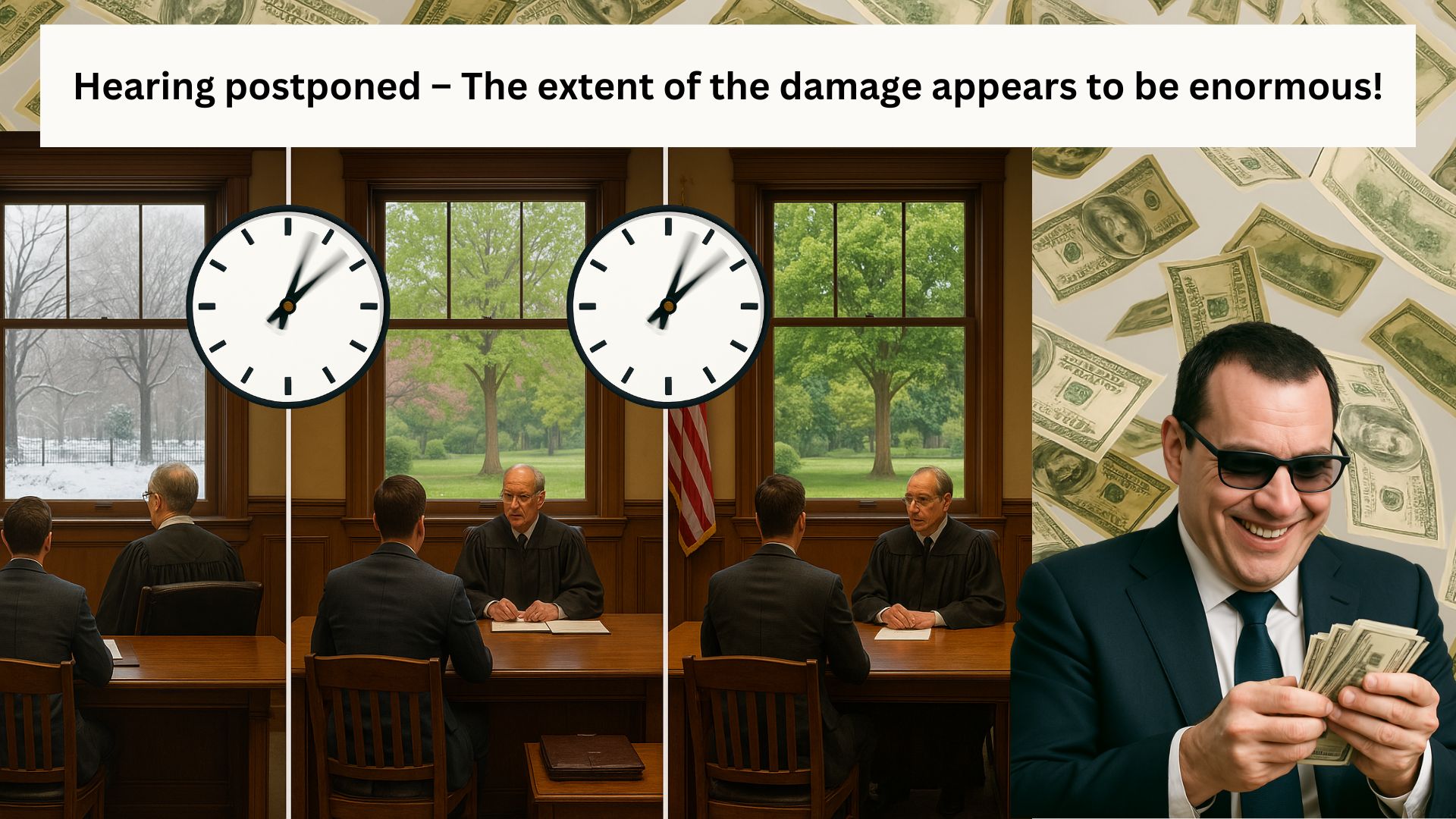

Legal defence strategy with prominent help

The US law firm Quinn Emanuel is currently defending the Apertum Foundation and Josip Heit against the TSSB’s accusations. According to their argument, the token APTM is a pure utility token, not a security. Furthermore, the DAO1 platform is blocked for US citizens and protected by geo-blocking.

Nevertheless, the criticism remains justified: there are no comparable protective mechanisms for European users. Rather, they run the risk of getting caught up in an opaque system with a questionable legal situation.

Conclusion: a fragile construct with high risk

DAO1 uses highly polished marketing to attract those who dream of quick crypto-wealth. But a closer look reveals numerous warning signs: lack of registration, warnings from supervisory authorities, unrealistic promises of returns and a model that is geared one-sidedly towards recruiting members.

Anyone who invests in DAO1 is entering uncharted territory – without regulatory protection, but with a considerable risk of loss.

Note: And as always, those affected are welcome to comment on this, or if someone has more or different information, they are welcome to share it with us. We are not interested in making false claims and our primary goal remains the provision of complete documentation.

Source: Quinn Emanuel Lawyers website, DAO1

Leave a Reply

Want to join the discussion?Feel free to contribute!