Lyconet/myWorld tax hell: Marketers in the crosshairs – voluntary disclosure or criminal proceedings?

The investigation into the Lyoness/Lyconet complex is gathering pace, and many could be in for a rude awakening. While some law enforcement agencies have been reluctant to act in the past, the tax authorities are now taking a much more decisive approach. Tax audits and investigations are spreading internationally, putting pressure not only on the puppet masters, but also on all those who have earned a lot of money as marketers.

Marketers bear responsibility – and could be liable to prosecution

Many intermediaries, who were delighted with their generous commissions, ignored the tax and criminal consequences of their actions. The reality is that the income generated by recruiting new marketers, often in five or six figures, was and is fully taxable. Tax offices in Austria and other countries have already begun to issue corresponding additional tax demands. Numerous tax assessment notices have been issued. Those who have remained inactive so far should urgently consider making a voluntary disclosure to avoid prosecution before the tax authorities become aware of them.

The trail leads to Monaco – and to possible exit taxation

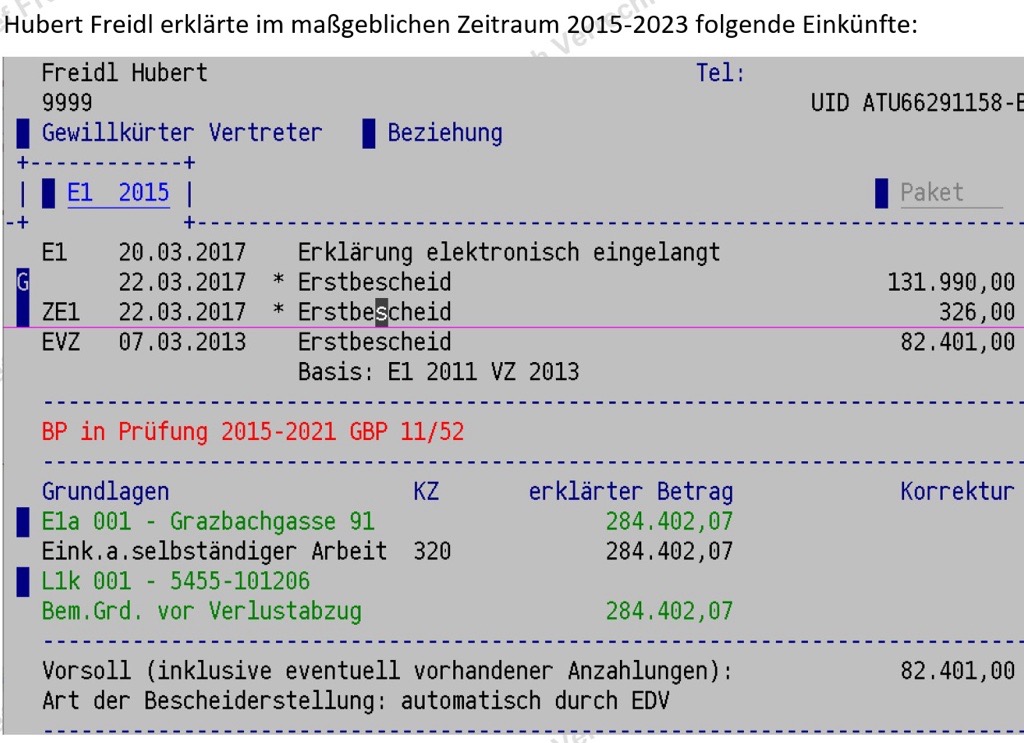

A recent example shows how far-reaching the investigations have become: Philanthropist Hubert Freidl, founder of the Lyoness/Lyconet7myWorld group, was officially registered in Austria for a long time, but had apparently strategically planned his actual relocation to Monaco. According to recent international information, Freidl had been resident in Monaco since 1 October 2016 and should therefore have been subject to so-called exit tax.

An excerpt from a current financial document highlights the explosive nature of the case:

“In a reply from Monaco dated 28 January 2025, it was confirmed that Mr Freidl and his wife have been registered as residents of Monaco since 1 October 2016. (…) There is a suspicion that Mr Freidl timed the transfer of his shares in such a way as to give the impression that the hidden reserves remained taxable in Austria. In fact, the assessment basis for the undeclared capital gains tax is likely to be in the double-digit million range.”

Systematic concealment?

Freidl is said to have transferred his shares in Lyoness International AG to Lyoness Group AG on 15 March 2017, while his official deregistration from Austria is dated 20 March 2017. Was everything orchestrated to avoid exit taxation? In reality, according to internal documents, Freidl had long since ceased to be resident in Austria at that point.

Witness protection and leniency programmes as a lifeline?

Under pressure from the tax authorities, some insiders are now beginning to talk – not least to save themselves. Witness protection and cooperation with the authorities suddenly seem more attractive than unconditional loyalty to Freidl. It is only a matter of time before someone delivers the decisive blow.

Conclusion

Marketers who have participated in the Lyoness, Lyconet & Co. systems and disregarded their tax obligations should no longer hope to remain undetected. The tide has turned. Voluntary disclosure can prevent the worst – before the tax authorities come knocking on your door.

Note: As always, those affected are welcome to comment, or if anyone has more or different information, they are welcome to share it with us. We are not interested in making false claims and our primary goal remains to provide complete documentation.

This article is based on publicly available information, in particular the report of the Office for Combating Fraud dated 26 March 2025. The presumption of innocence applies.

Leave a Reply

Want to join the discussion?Feel free to contribute!