Systematic deception – How Josip Heit and GSB built a global crypto-fraud construct

When a company promises returns of over 20 per cent annually, you should sit up and take notice. If it also promises this through an alleged ‘staking’ in the metaverse, then it sounds very much like science fiction – or like a scam. In the case of the controversial crypto-conglomerate GSB Gold Standard Bank and its founder Josip Heit, a 104-page official document from the Texas Financial Regulation Commission now speaks for itself: GSB is not a reputable financial services provider, but a highly opaque, fraudulent network that lured investors worldwide into a digital trap with fantasy products.

Promises of returns out of nowhere

At the centre of the allegations are so-called ‘Elemental Certificates’ and ‘Success Series Certificates’. They were touted with great fanfare as digital investment products with fixed USDT returns and the promise of building ‘generational wealth’. But the money was never paid out in the advertised stablecoin currency, but in the company’s own tokens with names like GEUR or CVEUR. What are they worth? Unclear. How can they be exchanged for real money? Only for a fee, and not always.

Particularly insidious: the company advertised staking programmes in its own ‘metaverse’ Lydian World, where people could allegedly earn up to 22.8% annually by holding the company’s own cryptocurrency LYS. This promise was never technically secured – there are no publicly viewable smart contracts that regulate payment or blocking periods. Instead, everything was based on blind trust in the platform – a house of cards that could collapse at any time.

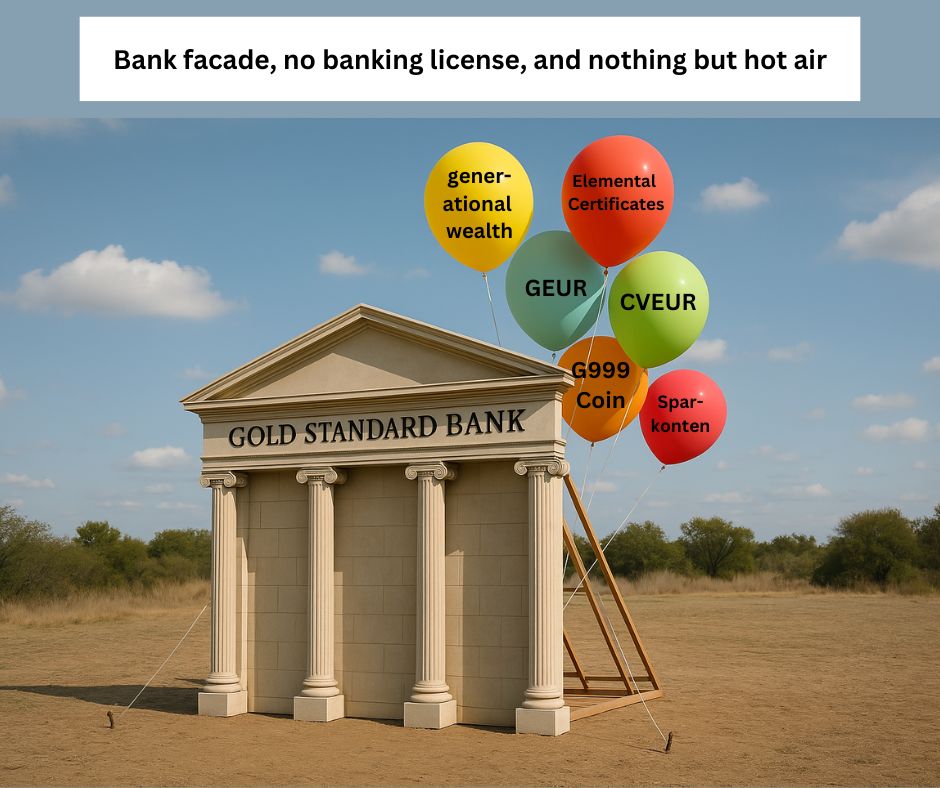

Fraud with a bank facade

To generate trust, GSB reached deep into its bag of tricks: it called itself ‘Gold Standard Bank’ even though it had no banking licence. It spoke of ‘savings accounts’, ‘liquid financial instruments’ and ‘convertibility into physical gold’. But here too: nothing but hot air. The G999 coin used is illiquid, hardly tradable on any platform and bears no relation to its presentation as a secure investment vehicle. The US financial regulator comes to a clear conclusion: here, the optics of a bank were constructed to deceive investors with devastating consequences.

Multilevel marketing in a pyramid scheme

The questionable products were sold using a classic MLM system: those who recruited new investors received commissions. But that too was illegal. Neither the products nor the salespeople were registered in Texas, although they were marketed there on a massive scale. In view of these facts, GSB’s own ethics charter, which every member had to sign, seems like a mockery.

What is more, many payouts to existing investors were apparently financed with the money of new members, a typical characteristic of a Ponzi scheme. The promised profitability was never covered by real profits, but by the redistribution of capital until the system collapsed at some point.

Josip Heit: string-puller and obscurantist

At the centre of the scheme: Josip Heit. The German entrepreneur controlled a network of companies in Germany, Kazakhstan, Sweden, Dubai and on the Comorian island of Moheli. One company after another was founded, dissolved or declared bankrupt. When the Texas Financial Regulator submitted a conditional settlement offer in September 2024, Heit signed. But he didn’t stick to it. Instead of creating transparency as promised, he blocked the investigations, provided false data and went into hiding in November 2024.

Under Heit’s leadership, money was spent on elaborate marketing events, sponsorships with stars like Floyd Mayweather and expensive promotional videos, while investors waited for payouts. A ‘market protection system’ was introduced that blocked customer funds for a year. It was explained to the public that this was allegedly to protect the system. In fact, as the authority suggests, it was more likely a desperate attempt to delay a liquidity collapse.

The next trick: rebranding and restarting

After the allegations became public, Heit and Co. apparently tried to continue under a new name. The platform ‘GSPro Network’, based in Georgia, allowed users to log in with old access data from ‘GSPartners’. When the US authorities became aware of this, access for North Americans was blocked.

It’s a pattern that runs throughout: when the pressure gets too great, the company name is changed, the country is left, the structure is reworked. The core remains the same: deception, greed, concealment.

Conclusion: the wolf in crypto’s fur

GSB and Josip Heit present themselves as visionary pioneers of the blockchain age. In fact, they act like classic con artists, except that today coins, metaverse and NFTs have taken the place of fake stock certificates. This case should be a warning to investors: just because an investment is ‘modern’ does not make it any less dangerous. On the contrary – the digital camouflage makes it even more difficult to see through the scam.

In any case, the Texas authorities are convinced that this is a fraud on an international scale. The question is no longer whether Josip Heit defrauded investors, but how many.

Note: At the time of publication, Josip Heit and the other parties involved are presumed innocent. A final judgement is still pending. The events described here are based on official investigations and publicly available documents from the Texas State Securities Board.

Note: And as always, those affected are welcome to comment on this, or if someone has more or different information, they are welcome to share it with us. We are not interested in making false claims and our primary goal remains the provision of complete documentation.

Sources:

¹ Texas State Securities Board, Emergency Cease and Desist Order No. ENF-23-CDO-1879, SSB Exhibit 1, pp. 2–3.² Ibid., pp. 5684–5704: Description of Elemental Certificates and internal tokens (GEUR, CVEUR etc.), ³ Ibid., pp. 5707–5710: Fee-based conversion of internal tokens into tradable coins, ⁴ Ibid., p. 2711–2784: ‘Staking in the metaverse’ with LYS tokens and non-existent smart contracts, ⁵ Ibid., p. 6021–6045: G999-Coin’s application as a ‘savings account’ and alleged gold convertibility, ⁶ Ibid., p. 5963–5971: Claim that GSB is not subject to regulation due to internal token payout, ⁷ Ibid., p. 5975–5983: clarification by the authority that the token exchange has no legal relevance, ⁸ Ibid., p. 6007–6015: unauthorised use of the term ‘bank’ and lack of a licence, ⁹ Ibid., p. 6131–6135: distribution system as illegal multi-level marketing (MLM), ¹⁰ Ibid., p. 6140–6148: terms and conditions clauses on waiver of legal action and limitation; misleading investors, ¹¹ Ibid., p. 5775–5783: internal financing of new certificates from investor funds, ¹² Ibid., pp. 5807–5815: 13-month lock-up through ‘Market Protection System’, non-transparent use of funds, ¹³ Ibid., pp. 5821–5852: trading teams playing down losses in the meta-portfolio, ¹⁴ First Amended Notice of Hearing, SOAH Docket No. 312-25-13515, points 14–16: breach of contract with regard to the term sheet, ¹⁵ Ibid., point 30: renaming as ‘GS Pro Network’, access blocked for US customers, ¹⁶ SSB Exhibit 1, pp. 452–499: company structure, international locations and resignation of Josip Heit.

Leave a Reply

Want to join the discussion?Feel free to contribute!